BNI Supply Chain Financing (SCF)

BNI Supply Chain Financing (SCF) is an invoice/bill financing solution for Corporates and Corporate Partners that accelerates payment receipt and increases payment certainty for both Corporate and Corporate Partners.

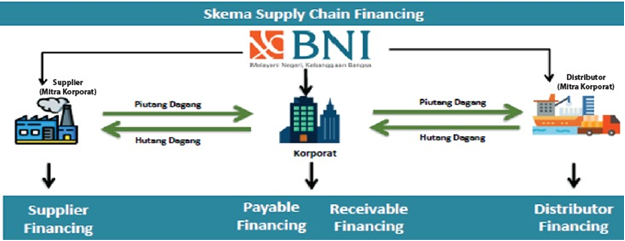

Bank Negara Indonesia, as a reputable bank, offers SCF financing in the form of :

- Supplier Financing.

Invoice financing facility for Corporate Partners as Sellers/Suppliers so that Sellers' Trade Receivable bills can be paid by Buyers more quickly.

- Distributor Financing.

Invoice financing facility for Corporate Partners as Buyers/Distributors to ensure timely payment of Buyers' Trade Payables to Sellers.

- Payable Financing.

Invoice financing facility for Corporates as Buyers so that Trade Payables to Sellers can be paid faster than the invoice due date.

- Receivable Financing.

Invoice financing facility for corporations as sellers so that trade receivable bills to buyers can be paid sooner than the invoice due date.

Because of the collaboration between Corporate, BNI, and Corporate Partners, the provisions and rates for the SCF scheme above will be more competitive than general financing, and it will be easier to monitor invoices with the availability of a webservice application (bni-fscm@bni.co.id, www.bnifscm.bni.co.id), and a mobile version for the BNI FSCM Platform will follow soon.

Benefits for Corporations and Corporate Partners :

- Ease and security in document transactions.

- Increase the likelihood of receiving invoice payments.

- Increase the speed with which invoice payments are received.

- Make invoice reconciliation easier.

- The ease with which transactions can be monitored using the BNI FSCM application.

- Offer a variety of invoice payment options.

- Simple integration with corporate systems or partners.

In addition to the digital payment method, BNI offers Smart Commerce Pay (SC Pay), which allows buyers to pay sellers based on the invoice value and payment time mutually agreed upon on the BNIDirect platform. Sellers can apply for a SC Pay takeover to BNI in order to receive payments faster.

Benefit :

- Simplifying the banking transactional mechanism in the business ecosystem.

- Ease of monitoring the payment settlement of sale and purchase transactions.

- Improving the accuracy of accounts payable and receivable.

- Increasing trust among the businesses involved.

Please contact us whenever you need further detail :

For more info please contact:

Service Action Team (SAT)

Telp : (021) 29946046

Email : tbs_sat@bni.co.id